By Michelle Price

Special to the UCBJ

PUTNAM COUNTY – Monday night, Putnam County commissioners will consider a 10-cent property tax increase to fund services and needed improvements, including a new school and an expansion of the current jail.

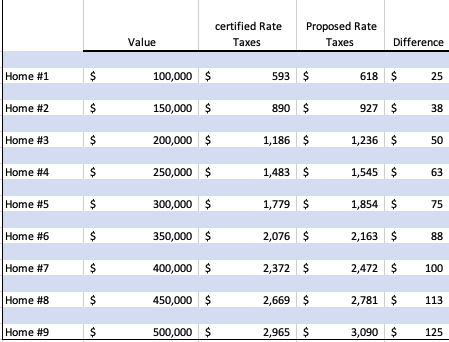

Many homeowners have expressed concerns about the potential impact to their wallets of the potential tax increase coupled with the recent countywide reappraisal of property, so the UCBJ sat down with Putnam County Property Assessor Steve Pierce to review the true impact of the proposal.

Pierce provided the UCBJ with one example:

A $200,000 Appraised Value House at last year’s tax rate of 2.926 paid $1,463 in county property taxes.

After Reappraisal, the new Appraised Value of $246,800 at the new tax rate (Certified Rate) of 2.372 would pay $1,463 in county property taxes – same as the previous year.

This house with the new Appraised Value of $246,800 and with the proposed tax increase of $0.10 at the new tax rate of 2.472 would pay $1,525 in county property taxes. This is a difference of $62 for the year.

The proposed increase of 10-cents would equal an increase of $25 per $100,000 in new appraised value.