By Michelle Price

Special to the UCBJ

UPPER CUMBERLAND – The Upper Cumberland is continuing its rebound at a much higher rate than the state as a whole. For the third consecutive month, August sales tax collections in the Upper Cumberland region again outpaced the state, more than doubling the increase over state collections for the same month in 2019.

Sales tax collections lag by one month, so August sales tax collections reflect July sales activity.

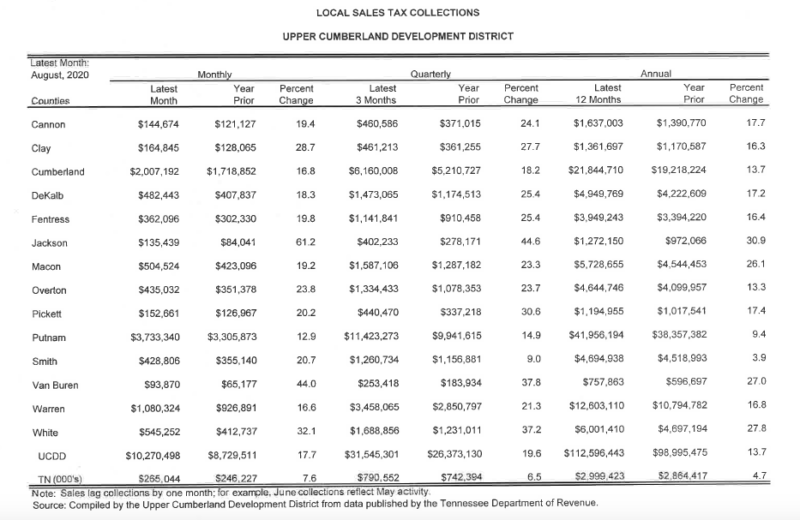

Local option sales tax collections showed the largest increase, jumping 17.7% over last year’s collections. All 14 U.C. counties had double digit increases with Jackson County’s collections at $135,439 increasing 61.2% over August 2019’s $84,041. Van Buren saw a 44% increase over August 2019 collections.

Although Putnam County’s retail sales have been impacted by COVID and the increase in people shopping in their home counties and via the internet, collections for local sales taxes were up $427,467 or 12.9% for the month of August 2019, the smallest percentage increase within the U.C.

The U.C. had a 17.7% increase over August 2019 collections compared to only a 7.6% increase statewide. In dollars, the region collected $10,270,498 in local taxes, a gain of $1,540,987 more than was collected in August 2019.

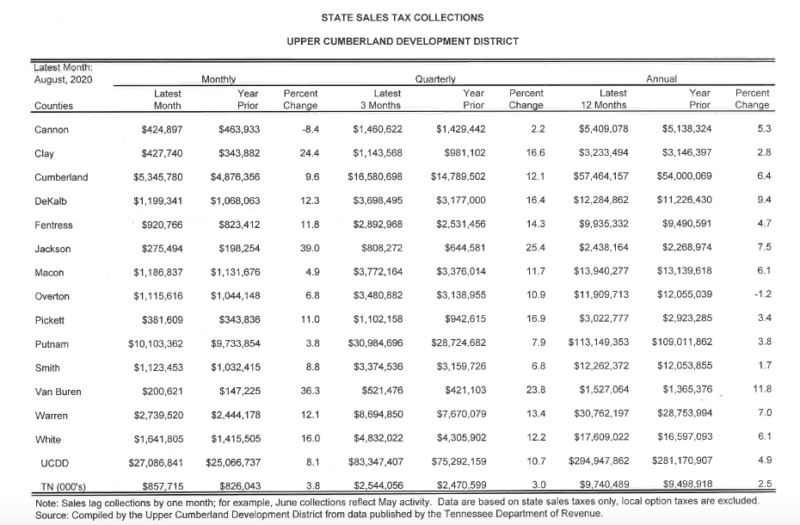

The increase in state sales taxes was smaller at 8.1% but was still considerably above the state’s 3.8% gain.

The only U.C. county that did not have a positive increase in state sales taxes was Cannon which reported an 8.4% decline in collections. The reasons for the decline are unknown, but it was unusual since the county reported a 19.4% increase in local sales taxes collected.

Jackson (up 39%) and Van Buren (up 36.3%) led the region in increased state sales tax.

Complete charts of tax collections compiled by the Upper Cumberland Development District from Tennessee Department of Revenue data are below.