By Amye Anderson

UCBJ Managing Editor

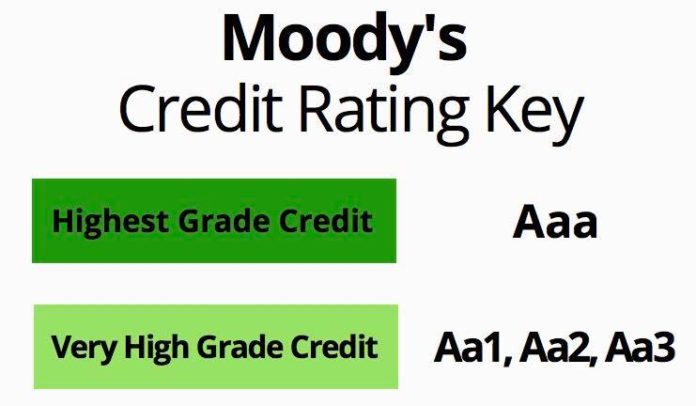

COOKEVILLE – It’s good news for the city and its finances. Moody’s Investors Service has upgraded Cookeville’s issuer rating and outstanding General Obligation Bonds to Aa2, an improvement from the previous Aa3 rating. The group has also assigned an Aa2 rating to the city’s $2.8 million Series 2017 GO Bonds.

Cookeville City Manager Mike Davidson says, going forward, the goal is to not only maintain the new rating but to improve upon it.

“The city is very pleased to receive a rating upgrade,” he said. “This is a great accomplishment for the city and its citizens. The strength of our local economy, the importance of a diverse tax base and maintaining strong fund balances was instrumental in this rating upgrade. Now our goal is to try and maintain this rating and improve on it.”

The upgraded ratings, according to Moody’s, are considered “very high-grade credit” on the rating scale and reflect the city’s “strong financial position marked by ample reserve levels and surplus operations and healthy tax base growth.” The rating also takes into consideration below-average wealth levels that are mitigated by the presence of Tennessee Tech University, and a moderate debt burden.

According to Brenda Imel, the city’s finance director, the general obligation bonds have financed the construction of Tennessee Avenue, the roadway connecting the new fifth interchange to I-40 to SR70, and the purchase of a new fire truck.

“This report is the most definitive proof you can get in the bond market that the city of Cookeville is a good steward of the public’s money and is good news for our residents,” she said. “The rating upgrade demonstrates that we are fiscally responsible with the public’s dollar.”

These bonds are payable and secured by an unlimited ad valorem tax – a tax amount based on the value of the item being taxed – to be levied on all taxable property within the corporate limits of the city of Cookeville.

“We are blessed to have excellent management by Finance Director Brenda Imel and City Manager Mike Davidson,” said Cookeville Mayor Ricky Shelton via social media. “As long as I’m your mayor, I will continue to help keep our taxes low, budget conservatively and drive tax base expansion with economic growth.”

According to Moody’s, the US Local Government General Obligation Debt, published in December 2016, was the principal methodology used in this rating. The previous Aa3 rating was issued in October 2015.